Performance

Kuvera performance charts

Click on a bar to see the value.

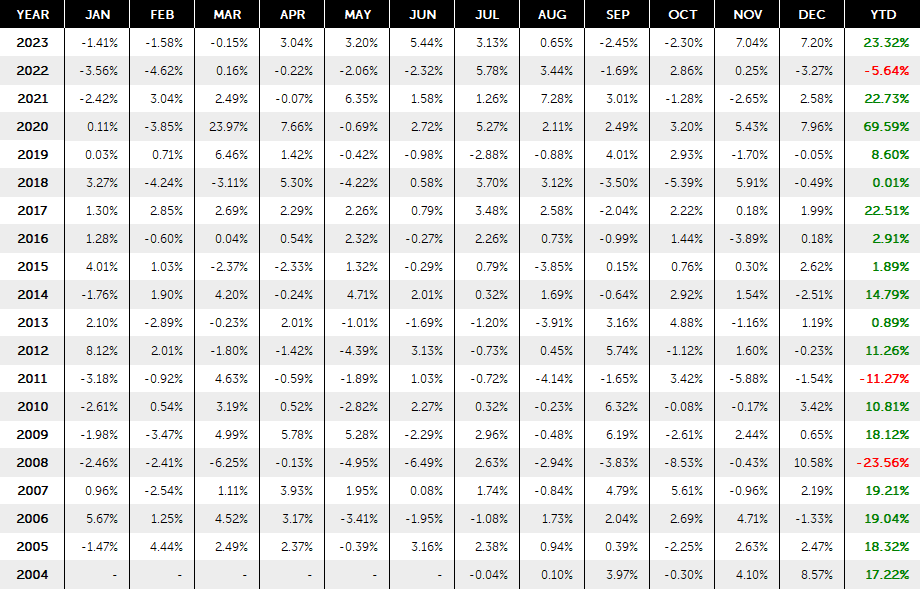

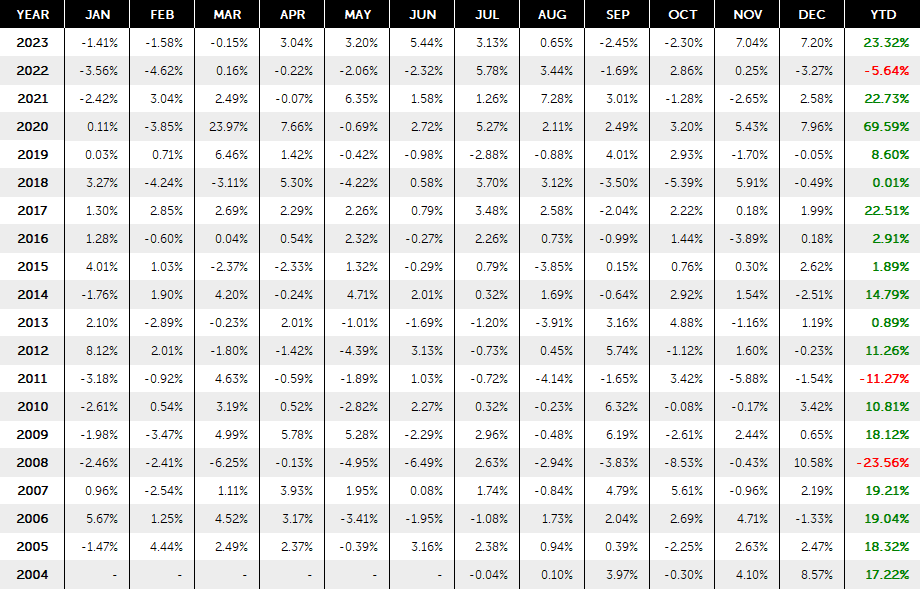

| ANNUALISED RETURN | STANDARD DEVIATION | |

|---|---|---|

| KFL | 11.37% | 12.13% |

| NIFTY | 10.96% | 25.90% |

Monthly Returns (Since Inception)

Kuvera Capital Partners LLP (KCP) is an alternative asset manager specialising in Indian Equities. KCP manages the Kuvera Fund (ISIN:MU0671S00000), one of the first Indian dedicated long/short funds to be launched. It was co-founded in 2004 by Raju Kamath with seeding from Marshall Wace. Kuvera provides clients with risk controlled access to the Indian market, one of the fastest growing in the world. Clients with Kuvera can maintain long-term exposure to a unique asset class and receive a great investment experience and stable long-term returns.

PerformanceClick on a bar to see the value.

| ANNUALISED RETURN | STANDARD DEVIATION | |

|---|---|---|

| KFL | 11.37% | 12.13% |

| NIFTY | 10.96% | 25.90% |

year history

of the index volatility

of the index's annualised return

Compound Annual Return

Standard Deviation

Sharpe Ratio

Rolling 5Y (annual return)

Rolling 3Y (annual return)

Rolling 1Y (annual return)

Max Drawdown (2008)

Winning Ratio

Investment Awards

Portfolios are constructed to extract the desired risk return profile with limits on position size, sector and exposures.

An understanding of global risks as they affect India.

Large cap focus: a detailed knowledge of companies in our universe.

An active short book made up of stocks not an Index.

Derivatives are used to hedge out residual portfolio risk.

Source: IIFL Asset Management

Current government commited to dismantling bureaucracy, devolving power and attracting capital.

India is supplied constrained and MUST attract foreign capital to achieve growth potential.

Growth and equity markets linked to global factors and liquidity.

21.3% of population below the poverty line.

Ranked 130th out of 189 countries in the World Bank's 2015 ease of doing business index.

GDP per capita is $1.8k. Government incentivised to elevate per capita numbers.

Founder, CEO & Head of Investments

Prior to founding Kuvera, Raju spent 10 years with Dimensional Fund Advisors, where he developed and managed emerging markets equity and derivatives portfolios.

Assets managed totalled $1bn, invested across 19 markets. His track record at Dimensional (31 Mar 2003): Morningstar ranked his Emerging Market Fund as the 2nd best performer (out of 107 funds), on a 5-year basis and 3rd best (out of 173 funds), on a 1-year basis.

The UK Fund ranked 7th (out of 123 funds) on a 3-year basis and 10th (out of 69 funds) on a 1-year basis. He has an MBA (Finance) from Cass Business School, City University.

COO

Wilson is the Chief Operating Officer of the Kuvera Fund. He is responsible for overseeing multiple business functions and assists in the development of the firm's long-range business plan.

Previously, he was a Partner at Sigrun Partners as well as Managing Director at Fortis Bank (Now BNP PARIBAS FORTIS). Wilson has held senior positions at Abn Amro Bank, ACF Corporacion and other international and regional financial institutions.

He is a Chartered Financial Analyst (CFA) as well as a Professional Risk Manager (PRM). He holds an MBA as well as a BBA.

CFO

Previously Rohit was with BP Oil Trading for 15 years in London and South Africa.

His responsibilities included the automation and improvement of both back and front office processes as well as development of risk management systems for European Oil Trading. He subsequently founded an IT business.

At Kuvera, Rohit is responsible for improving the efficiency of operational controls and automation of both back and front office processes. He is an IT specialist and a qualified accountant.